Happy Sunday Traders!

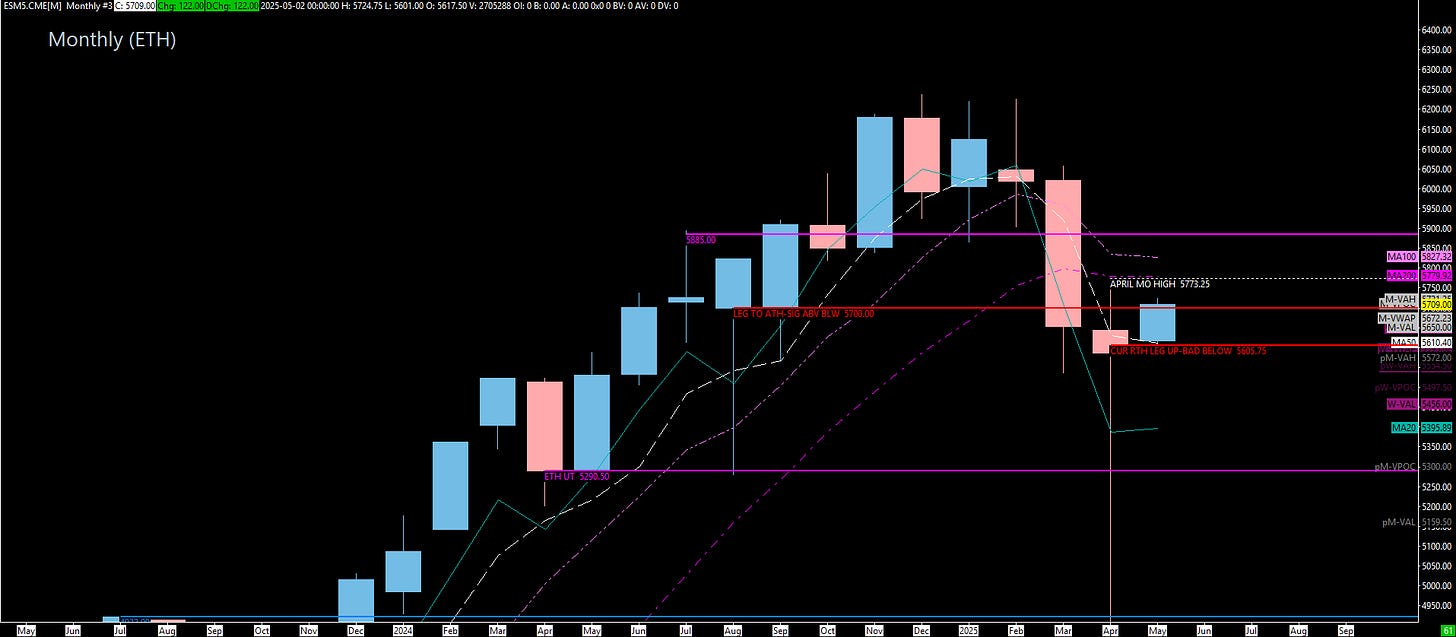

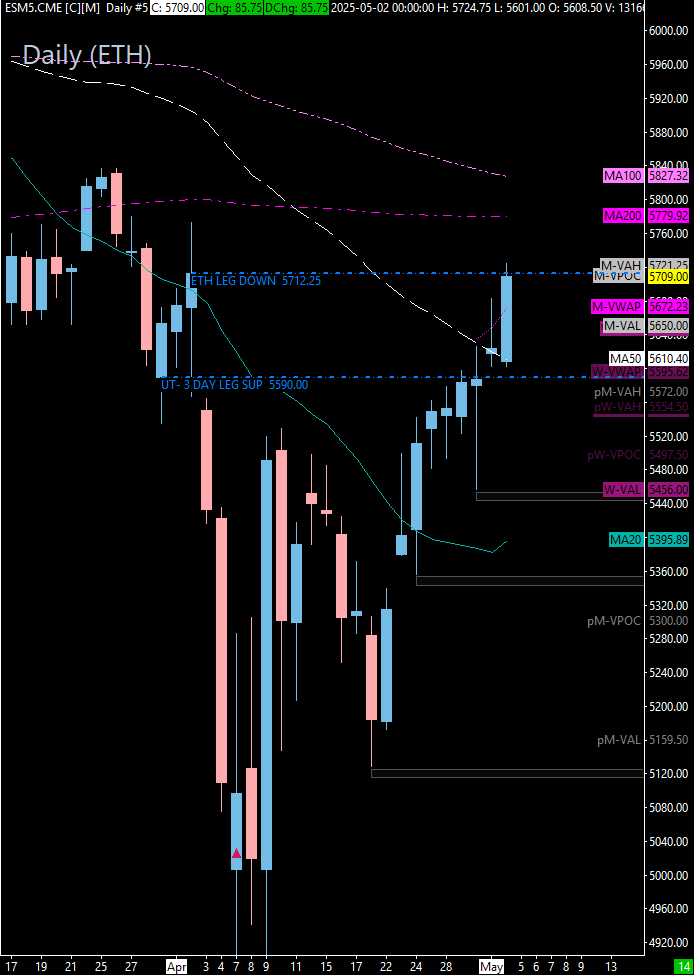

What a run it’s been — nine straight green days and we’ve officially marched right into the upper boundary of a major resistance zone. In this weekend’s review, I break down key inflection points using the front-month ES contract to get sharper insight into what could come next.

We’re sitting just below the yearly VWAP and stacked moving averages — with major structure right above us and untested support below. In other words: we’re entering a make-or-break zone.

🔥 Key Resistance Levels (Upside Targets)

5700 – Critical pivot; monthly leg to the all-time high (RTH chart)

5712–5724 – Must build value above this range to continue higher

5729 – Untested daily level just above recent highs

5745 – Yearly VWAP

5827 – 200-day and 100-day moving averages converge here

5800–5815 – Projected push target only if we break and build above 5724

🛡️ Key Support Zones (Downside Targets)

5688.50 – Untested support

5678.50 – Minor support but already tested

5638–5640 – High-probability support zone (daily + weekly confluence)

5594 – Prior swing support and base of current move

5605 – Monthly leg to recent move up

5550–5563 – Multi-timeframe cluster: daily, 4-hour, VWAP, and monthly

5538–5543 – Deep support, previous weekly lows and daily shelf

🧭 Primary Thesis:

Despite the bullish momentum, price has run head-first into an area that previously rejected hard. Without a close above 5718 and value building over 5712–5724, any breakout attempt could fail — potentially triggering an 80-point pullback back toward the 5638–5590 zone.

🧨 If 5700 fails, the real test begins. Expect sellers to step in toward 5688 → 5638 → 5594.

⚠️ However, support is dense and buyers are likely to defend, so while I’m prepared for a pullback, I’ll be taking it level by level.

🗺️ Final Thoughts:

We’re pressing into a major decision zone, and this coming week could set the tone for the rest of the month. Watch for signs of exhaustion or strength and don't chase either way. The next 40–80 points will be defined by structure and confirmation, not guesses.

🚀 Bonus Resources:

📊 See the charts mentioned in the video – screenshots posted below for clarity.

💬 Join the conversation and get live setups in our Discord community:

👉 Join the VICI Discord here

Until next time — trade smart, stay prepared, and together we will conquer these markets.

Ryan Bailey

VICI Trading Solutions

REFERENCE CHARTS

MONTHLY

WEEKLY RTH & ETH

RTH DAILY

WK TPO

ETH DAILY

4HR

1HR COMPLETE

YEARLY VWAP VALUE AND MOVING AVERAGES

Share this post