🧠 Current Market Context:

We're trading around 6340.00, just shy of fresh all-time highs, in a three-week balancing area. Two critical weekly composite Points of Control (POCs) have aligned at 6300.00, which gives us a powerful pivot going into this week. Although the market remains bullish structurally, we have notable inefficiencies lower (weekly singles at 6166.00) that could attract price if momentum shifts. Let's unpack exactly how to trade these scenarios.

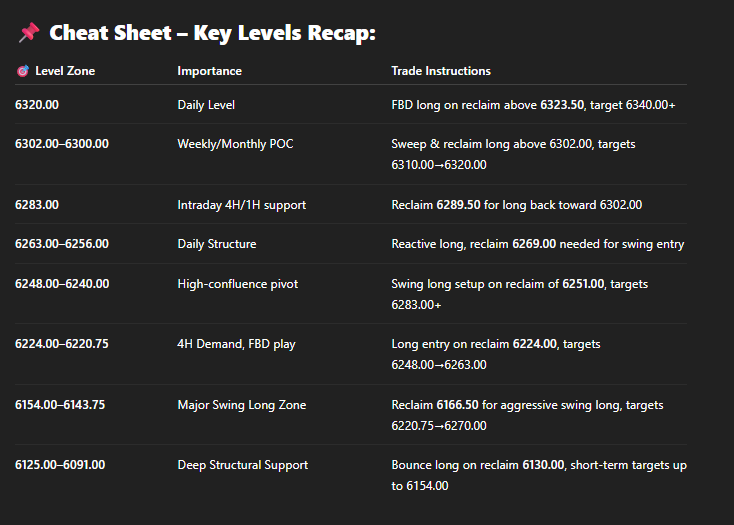

🎯 Detailed Actionable Trade Plan:

🔵 1) Current Support: 6320.00 (Daily Level)

On Friday, we played the 6323.50 daily level perfectly. We bounced about 17 points off it.

6320.00 remains an untested daily level.

Actionable Setup (FBD Scenario):

If price flushes into 6320.00 and quickly reclaims 6323.50, this signals a strong failed breakdown scenario.

Entry Trigger: Long entry upon reclaim and acceptance above 6323.50.

Targets: 6340.00 initially, with potential continuation to fresh highs above 6350.00.

Invalidation: Close a daily candle below 6320.00.

🔵 2) Major Confluence Area: 6302.00–6300.00

Critical due to alignment of multiple key references:

Two separate Weekly Composite POCs at 6300.00.

Untested Weekly Level at 6302.00.

Monthly POC at 6303.00.

Minor bearish imbalance cleanup area.

Actionable Setup:

Ideally, price sweeps slightly below this zone, testing 6299.00 (untested 4H), then quickly reclaims 6302.00.

Entry Trigger: Confirmed reclaim and hold above 6302.00–6303.00.

Targets: 6310.00 (initial), then 6320.00 and higher.

Stop Placement: Below 6299.00.

🔵 3) Intraday Level: 6283.00

Untested 4-hour and 1-hour structural confluence.

Great spot for intraday rotation if price drops further.

Actionable Setup:

If price trades down into 6283.00, watch closely for signs of buying strength.

Entry Trigger: Clear reclaim of 6289.50 confirms buyers stepping in.

Targets: Back towards 6300.00–6302.00, with potential runners towards 6320.00.

Stop Placement: Below 6280.00.

🚨 Momentum Shift Levels (Bearish Scenario):

6323.50–6320.00: Daily close beneath here is your first red flag signaling weakening momentum.

6248.00: Major daily pivot—closing below this would indicate significant bearish momentum shift, opening lower targets.

📉 Lower Levels & Key Swing Areas (If Market Sells Off):

If we see significant downside momentum develop, these lower levels become critical:

6263.00–6256.00: ETH daily structure & minor gap fill.

6248.00–6240.00: Daily, 4-hour, Weekly POC confluence. Major pivot and swing zone. Reclaim above 6251.00 confirms bullish reversal.

6224.00–6220.75: Four-hour demand—excellent Failed Breakdown (FBD) long setup upon reclaim of 6224.00.

6154.00–6143.75: Massive high-timeframe confluence (untested daily levels, naked weekly POC at 6147.25, weekly singles cleanup at 6160.75).

Major swing long opportunity triggers upon reclaiming previous ATH level at 6166.50.

6125.00–6091.00: Deeper structural support. Reclaim of 6130.00 confirms a short-term bullish reversal setup.

🧠 Final Thoughts:

We remain in a structurally bullish market environment, especially with price acceptance above 6300.00. Each of these outlined levels offers clear, actionable trading plans. Follow the reclaim confirmations closely, manage risk strictly below these key levels, and stay prepared for powerful rotations or squeezes.

Until next time—trade smart, stay disciplined, and together we'll conquer these markets.

– Ryan Bailey, VICI Trading Solutions

Share this post