Hello Traders,

In trading, one of the most powerful insights you can gain comes from understanding the concept of market imbalances. It’s like having a window into the tug-of-war between buyers and sellers, and if you know what to look for, it can be the key to sharper, more confident trade decisions.

But, as with anything in trading, it’s about knowing how to interpret the signals and act accordingly. So, let’s break it down, keeping things fresh, simple, and actionable—just how we like it.

What is a Market Imbalance?

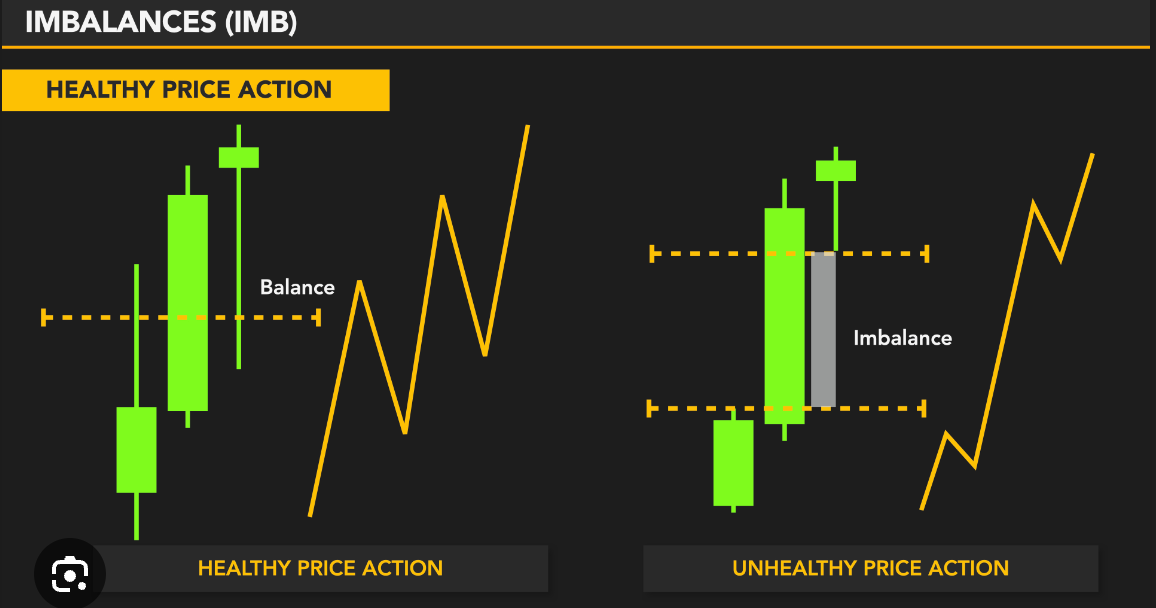

At its core, an imbalance occurs when there’s a significant difference between buying and selling volume at a given price level. Picture a market order book like a seesaw—when the weight shifts heavily to one side (either buyers or sellers), the market reacts. This imbalance often leads to sharp price movements as liquidity dries up and the market seeks equilibrium.

Now, here’s where the magic happens. By identifying these moments early, you can jump in ahead of the broader market and catch those moves with precision.

Recognizing Imbalances in Real-Time

You might be thinking, “How do I spot these imbalances without overcomplicating things?” Great question! You don’t need a dozen screens or fancy algorithms. Here are some straightforward methods to help you:

Order Flow Tools: If you’re using order flow software, you’ll notice a market imbalance when large buy or sell orders start stacking up at certain price levels. These tools give you a real-time look at where buyers and sellers are sitting, making it easier to see the power struggle unfold.

Volume Profile: Another great tool is the volume profile, which shows you how much volume has traded at different price levels. Imbalances tend to occur when there’s a sudden drop-off in volume at key levels, leaving the market vulnerable to rapid moves.

Cumulative Delta: This is another indicator I like to keep an eye on. Cumulative delta shows the net buying and selling activity over time. When you see a significant divergence between price action and delta, it can signal an imbalance in buyer/seller strength.

I like to keep things simple, so if you’re just getting started, focus on one or two of these tools. Too much data can cloud your decision-making.

Using Imbalances to Create a Trade Setup

Alright, now to the fun part—how to trade these imbalances.

Let’s say we’re looking at a scenario where there’s a strong buying imbalance at a key support level. You can see buyers stepping in, orders stacking up, but price hasn’t moved yet. This is your cue that an upward move might be on the horizon.

Enter at the Zone of Imbalance: When you identify a zone where there’s a heavy buyer imbalance, look to enter around this level, especially if it lines up with a key support area. For confirmation, you can check for bullish price action—like a higher low forming—or a significant uptick in volume.

Set Your Stop Below the Imbalance: Since imbalances can sometimes be false signals, place your stop just below the imbalance zone or support level to protect your downside. That way, if the market doesn’t follow through, you’re out with minimal damage.

Take Profit at the Next Resistance or Key Level: Look for the next resistance zone or high-volume area to set your target. Market imbalances often result in quick bursts of movement, so your profit should be within reach fairly quickly if the trade goes in your favor.

A Recent Example of Market Imbalance in Action

Let’s use a real-world example to bring this to life. Recently, we saw a significant imbalance in the S&P 500 futures during a morning session.

Around the first hour of trading (when the Initial Balance is forming), sellers were dominating, pushing the price down. However, as price hit a key support zone, I started to notice a buyer imbalance—large buy orders were coming in, but the price wasn’t moving up just yet.

That was the signal. The market had found its floor.

I entered long at the support zone, keeping my stop just below. Sure enough, once the imbalance took hold, the price rallied quickly, and I was able to ride the move up to the next resistance level for a solid win.

This kind of setup doesn’t happen every day, but when it does, it’s one of the cleaner, more reliable trades out there.

A Few Final Thoughts

If you’re new to spotting imbalances, don’t worry if it feels like you’re missing them at first. Like anything in trading, it takes time to develop your eye for these patterns. But once you start recognizing the signs, you’ll find that imbalances offer some of the most reliable and actionable trade opportunities.

So, as you move forward in your trading journey, keep an eye on the market’s push and pull, and be ready to step in when one side starts overpowering the other. In trading, it’s all about finding your edge, and imbalances can be a strong part of your arsenal.

As always, feel free to reach out with any questions or thoughts. I love hearing your feedback. Trade smart and stay patient—and together we will conquer the markets

Ryan Bailey

VICI Trading Solutions

If you would like to learn more about TPO Market Profile CLICK HERE