Happy Weekend Traders,

Last week was nothing short of extraordinary, with the market rallying an impressive 240 points in under three days. This squeeze was among the most dramatic we’ve seen recently. The ES futures, which had dropped more than 5% the prior week, touched our weekly support at 5396.25 perfectly. After a brief consolidation at this level, bearish momentum was reversed, with CPI acting as the catalyst for a substantial bullish reaction. This caught many short sellers off guard.

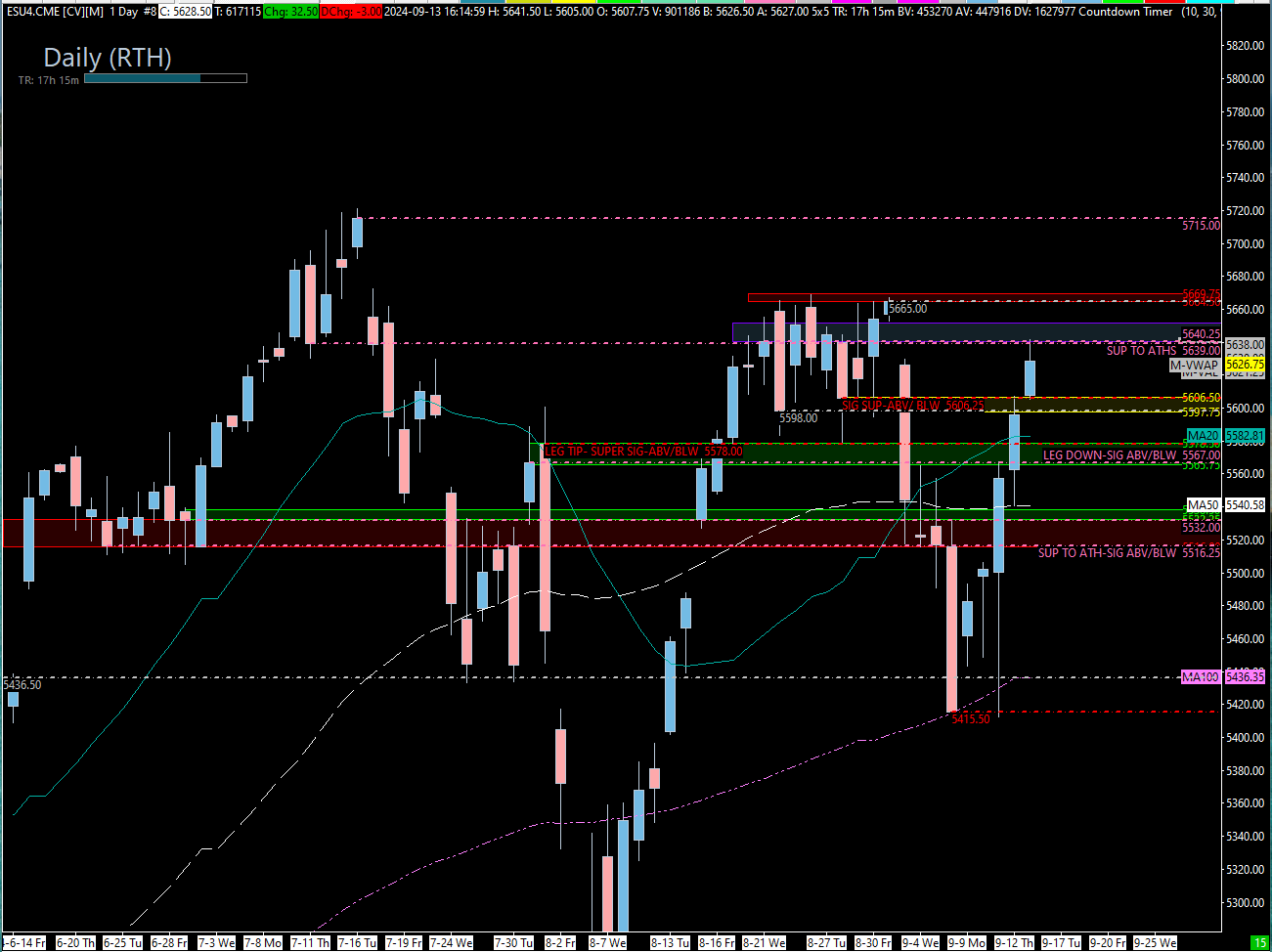

Once the price breached the 5436 daily level—a key marker from our AM Outlook—the squeeze began. The surge above 5500 triggered an unstoppable buy program, propelling us 140 points higher by day’s end.

The rally extended into the following day. Initially, overhead resistance at 5580.50 identified pre-market caused a 40-point drop to our first support level at 5543.75—a level highlighted in the Morning Insight. The price then rallied back up to 5606 daily resistance, as noted in the cheat sheet. On Friday, bulls managed to hold above 5606.25, aligning with our morning forecast.

“Overnight, we've drifted upward, holding at the 5598-5606.25 daily levels. These are the support zones that in August pushed us to the local highs at 5670. They are extremely important for price to be above for an immediate continued upside move.”

The price then moved into the significant 5639 to 5641.50 resistance area. This level was called out in real time on Friday for Substack subscribers via chat and email, proving to be the top of the day with reactions occurring not just once, but three times.

With such a significant rally and major news events throughout the week—including the Federal FOMC announcement on rate cuts—extreme volatility is expected in the coming week. The pressing question is whether this rally will continue or if the bulls will need a pullback to attract new buyers. Check out the video below where I detail the trade plan for next week and the high-probability setups I’m focusing on. In the video, I'll review these setups in real-time. A written trade plan is also provided below for your reference throughout the week.

Stay prepared, execute your plan, and let’s conquer these markets together.

Cheers!

Ryan Bailey

VICI Trading Solutions

News: EST

Trade Plan:

Shorts:

- Overhead Resistance: We face significant resistance between 5639 and 5650. This area could challenge the current price action, potentially leading to a pullback as it did in the previous weeks.

-5639-5641 is our key daily area, with a weekly level at 5650.50—also a gap fill. If the price pops up to 5650 and then drops below 5639, this could set up a short. Targets should be taken line-to-line due to the bulls’ strong control.

- First Target: 5606, followed by 5598.50.

- Further Drop: If 5598.50 is lost, a continued short could push the price to 5578 and potentially 5564.75. Caution is advised below 5578 as these levels have previously provided significant reactions.

Longs:

5564.75-5569.25 (4-Hour/Daily Combination):

- This zone shows strong confluence, including the previous day’s POC and last weeks value area high. I’d consider buying here with initial targets around 5578. If the price reclaims 5580.50, I’d add full size and trail the trade higher.

Lower Buy at 5532 (Significant Daily/Weekly Level):

- If the price drops to 5532, be cautious and bid with half size. Look for a reclaim of Thursday’s low and a move above 5543.75 (4-Hour) before increasing position size. Targets would be 5564.75 and higher.

Final Long Opportunity at 5513.75-5526.25:

- This area is significant daily support and may offer a reaction. However, this level needs to immediately reclaim 5532 to maintain long interest. As we move lower, support becomes weaker, posing additional challenges for bulls. Below 5500, bulls may struggle to retain control and long opportunities become a lower probability of success.

Final Note

Regardless of whether the market continues to push up immediately or pulls back before rallying again, the range between 5639 and 5668.78 will be challenging. A breakout above 5668.75 could signal a strong move higher targeting our upside daily at 5715.

Cheat Sheets

Highlighted Levels are areas of HIGH Interest

Weekly TPO

Daily TPO

Daily RTH

4 Hour

30 MIN RTH

Weekend Review