Hey Crypto Enthusiasts,

Let's talk about the wild ride in the crypto world, kicked off by the buzz around a potential BTC spot ETF by Black Rock. Despite years of attempts by others, it might just take the world's largest fund manager to nail it. But before we get carried away – remember, they haven't yet secured approval. And we've been down this road before. The industry adage "Buy the Rumor and Sell the News" rings true more often than not. With Bitcoin and several altcoins hitting resistance levels, it's prudent to exercise caution, especially with the ETF decision looming in January.

This post isn't just about Bitcoin or the ETF. It's about setting the stage for a discussion on Solana (SOL) – a project that lit up the crypto scene in 2021/22 alongside the rise (and fall) of FTX.

Solana was hailed as an Ethereum killer: speedy, flexible, smart contract-ready, low fees, lightning-fast transactions. When it debuted, developers flocked, and its price soared. Then came FTX's collapse, dragging Solana down with it. As a seasoned crypto player since 2016, I distanced myself from anything FTX-related, Solana included. Yet, to my surprise, despite the turmoil, Solana's resilient community kept the project afloat.

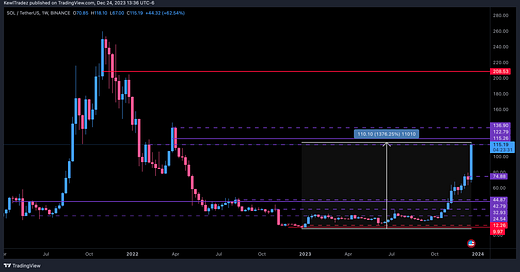

Fast forward to now, and Solana's chart is a sight to behold. It's like watching a cartoon rocket launch – a straight shot to the moon. The recent run is staggering: over 1376% from $8 to $118. Such meteoric rises are a crypto specialty, and I'm glad I’m here to witness them!!

But what do you do when an asset skyrockets like that? Media and FOMO might scream "Buy!" but my trader's instinct and technical analysis say otherwise. Solana's hit major weekly resistance level at $115.26 and looming directly overhead a major monthly level at $122.79. IMO a pullback seems likely, potentially to $74.88, where substantial support formed over multiple weeks. This could be an entry point for long-term investors, depending on your belief in Solana and the broader crypto market's response to the ETF decision.

Below are other attractive support levels: $45, $33, and around $25. These are my go-to zones for potential entry points for adding to long-term positions, considering the current market dynamics and potential reactions.

The key takeaway? Understand where we are with Solana's price action, the risks, and the potential scenarios based on our current trade location. As always, keep your risk in check and don't let FOMO cloud your judgment.

For clarity on my chart annotations, check out this post HERE.

Stay smart, take profits, and let's navigate these exciting times together!

Enjoy Your Holidays Traders

All the Best,

Ryan Bailey

Vici Trading Solutions

Important Disclaimer:

It's crucial to understand that I am not a licensed financial advisor. The trade setups I share are strictly for educational purposes ONLY. They are meant to supplement the ongoing learning of my students and all market enthusiasts. These are not recommendations for taking trades blindly. Instead, they are guides to aid your own research and decision-making process. You bear full responsibility for your trade research, execution, due diligence, and overall performance. By reading this, you agree to hold Vici Trading Solutions & Ryan Bailey harmless from any financial responsibility for trades presented here and acknowledge that this SubStack is solely for continued education, to be used for that purpose alone.

Ok now that we got that out of the way… Lets go Conquer these Markets !!