Hello traders!

Today was a fantastic day to be a part of Team Vici! Our plan played out to perfection. Our 5852 daily level held firmly, launching us 35 points directly to the previous weekly value area high at 5886.

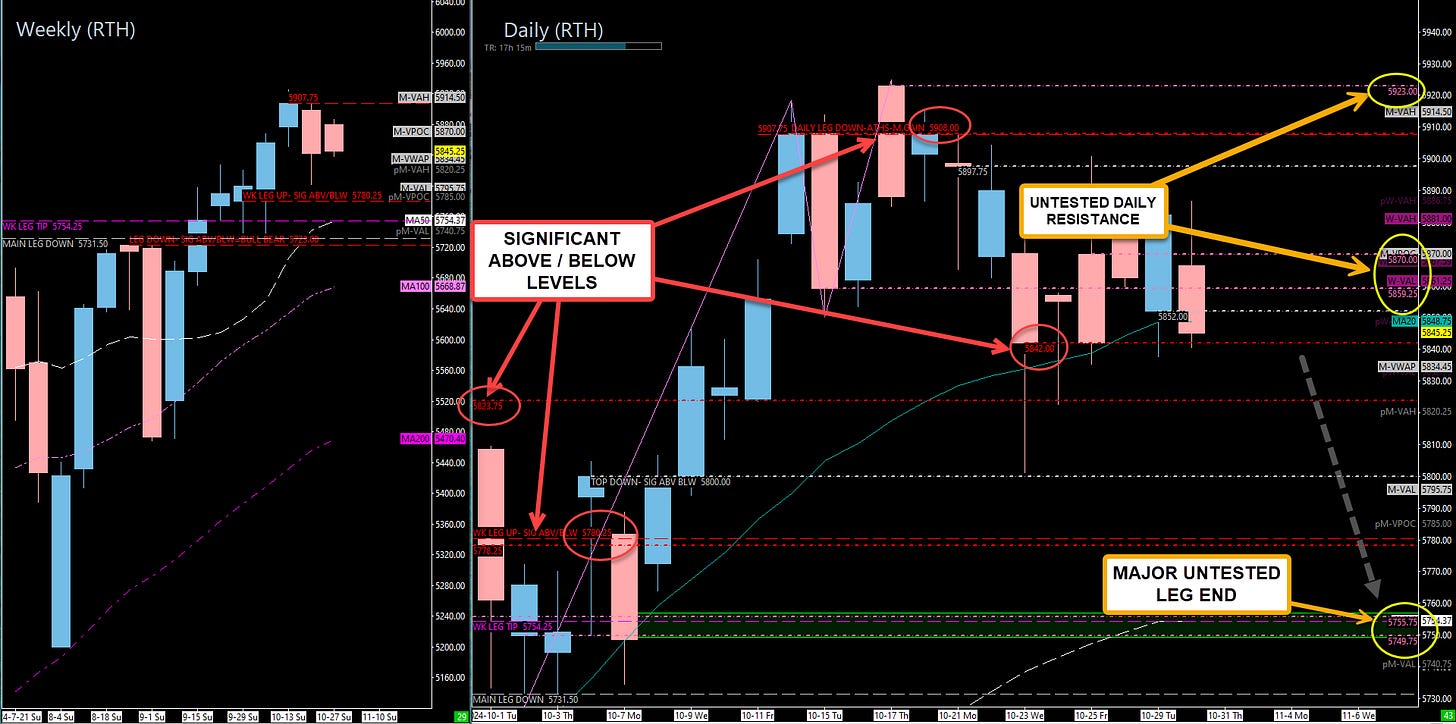

At that level, price stalled and reversed, reinforcing the weakness we’ve been calling for since last weekend. With another soft close on the daily timeframe, it seems the bulls are struggling to maintain control. Tomorrow brings big red tag news events, including CORE PCE and UNEMPLOYMENT CLAIMS, which are sure to stir up market volatility. Check out the trade plan below as we review the key untested levels and prepare for the opportunities ahead.

Let’s stay focused and conquer these markets together!

Ryan Bailey

Vici Trading Solutions

NEWS

OPTIONS VOL

LEVELS

CHEAT SHEETS

WK/DAY TPO

WK/DAY

4HR

Trade Plan

As you all know, we’ve been calling for weakness in the market ever since we lost daily support to the all-time highs last Wednesday. Since then, price has drifted in a 50-point range without any meaningful progress, even with the big tech earnings. Today’s soft close below the 5859.25 daily leg and 5852 support confirms this weakness. Although price briefly launched higher from 5852 today, the failure to maintain that support shows the bulls are struggling, and Globex is already gapping down.

As I mentioned, 5750s is still my main target, but the path we take to get there is uncertain. Now that support is being lost, many levels previously tested will act as resistance on first touch. Below is the detailed trade plan with the levels to watch for tomorrow.

Critical Levels to Watch:

5870 / 5873.25 (Daily Resistance / 4-Hour):

This daily level has been key all week, and it’s now untested after today’s reset. Directly above sits the 5873.25 4-hour level. Both will act as resistance, and if price fails here, expect a move toward 5849 or lower into 5842.5859.25 (Daily Leg End to ATHs):

This has been a critical level in our trade plan for weeks. It’s now untested from the bottom up after today’s action. A failure to reclaim this level will likely push us back into 5852 daily support or the 5842-5837.75 zone.5852 (New Daily Leg Up):

This level gave us 35 points today, but it now sits between 5870 resistance and 5842 support. With a 4-hour confluence at 5850, this zone could act as resistance on the next test.5842 - 5837.75 (Daily Cluster / 4-Hour Support):

This was Tuesday’s low and provided a solid reaction. However, it has now been tested multiple times and is at risk of breaking. A move below here will likely push price into 5823.75.5823.75 (Daily Pivot):

This is a key pivot level for momentum. While a reaction may occur, the level has been heavily tested and may not hold. A break will open the door to 5811 and 5802-5800.

Lower Support Levels:

5802 - 5800 (Daily/4-Hour Combo):

This level has provided strong support but may weaken with further tests. Market inefficiency around 5802 suggests that price could be drawn to this level for a clean-up.5780.25 - 5778.25 (Weekly/Daily Line in the Sand):

This high-timeframe zone is critical for the bulls. A breach will indicate a momentum shift to the downside. Monitor this area closely as it serves as our above/below marker.5755.75 - 5749.75 (Daily/Weekly Support Cluster):

This untested support cluster combines both daily and weekly levels, making it a prime buy zone. If this area holds, it could spark a rally back toward new all-time highs.5723 (Weekly Bull/Bear Line):

A breach below 5749.75 will likely trigger a move toward 5723, a key level that separates bullish continuation from bearish momentum.

Bearish Case:

5705.25 (4-Hour):

If 5723 fails, this will be the next downside target. Bulls must reclaim 5726 quickly to avoid further losses.5690 (Weekly Leg Tip):

A break below this level signals a major shift toward bearish sentiment and will likely invite more selling pressure.5666.00 (Major Bull/Bear Line):

This is the final dividing line between bullish continuation and bearish momentum. Losing this level hands full control to the bears.

Upside Levels to Monitor:

5908 (Daily Level):

A daily close above this level will restore bullish momentum and set the stage for a push higher.5918.75 (4-Hour) and 5923 (Daily Resistance):

These untested levels could provide reactions if tested. Watch for potential pullbacks at these levels, but clearing them opens the door to resolving the bullish imbalance above.

Key Takeaways:

Critical Support Levels:

Monitor 5780, 5823.75, and 5859.25 closely to spot momentum shifts.Buy Zone:

5852 remains a key daily leg up and could provide a solid reaction, pushing price back toward 5900. Below that, the 5755.75 - 5749.75 cluster offers a high-probability support zone.Bullish Bias:

As long as 5837.75 holds, the bullish momentum remains intact. However, a break below this level will shift momentum toward 5823.75 and signal increased downside risk.Upside Targets:

Watch 5918.75 (4-Hour) and 5923 (Daily) closely. Clearing these levels keeps the bulls in control and brings us closer to resolving the bullish imbalance above.

Stay sharp, follow the plan, and let’s conquer these markets!

Ryan Bailey

Vici Trading Solutions