Hello traders!

Today was a choppy one as price gapped up on Sunday night but drifted downward into our 5859.25 significant daily level throughout the morning session. This level has proven crucial over the past two weeks, acting as a key pivot for continuation in either direction. The market seemed to take a breather today, but starting Tuesday, we’ll see daily red tag news, which should inject some much-needed volatility.

For Tuesday, keep an eye on Consumer Confidence and JOLTS Job Openings at 10:00 a.m. EST, as these events are likely to move the markets.

Check out the detailed trade plan and the key levels below to see how I’m approaching tomorrow’s session. Remember: Be safe, stay sharp, and stick to the plan. Together, let’s conquer these markets!

Ryan Bailey

Vici Trading Solutions

NEWS

OPTIONS VOL

LEVELS

CHEAT SHEETS

WK/ DAY TPO

WK / DAY RTH

4HR

Trade Plan

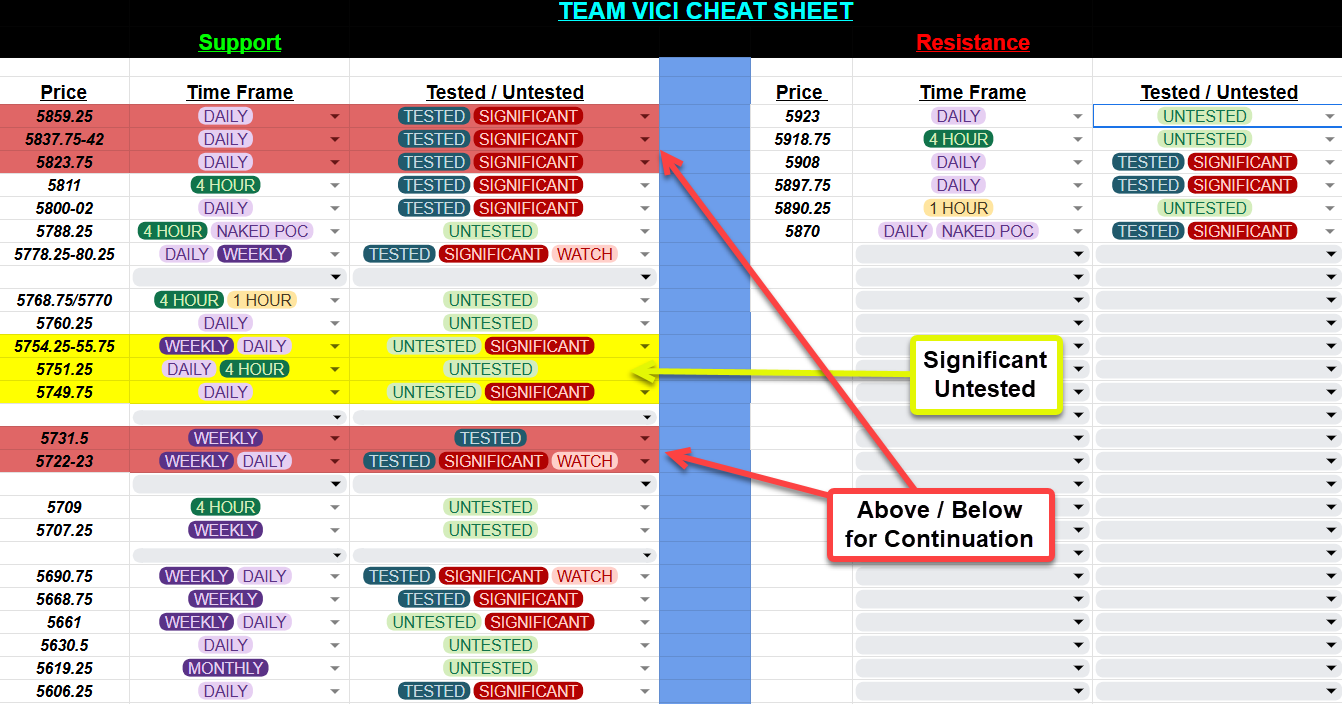

Today’s market action was slow and deliberate, with price slowly grinding downward. However, if you followed the plan, you were able to take advantage of the short from 5880 to 5860 for a nice 20-point win—though the pace was sluggish. As we prepare for tomorrow, the 5859.25 daily level remains a key focus, as it continues to act as a guide for potential upside or downside momentum.

Our resistance at 5870 is also critical, as it aligns with yesterday’s POC—an area known for generating reactions. Below 5859.25, we have a gap fill target around 5841.50, along with a cluster of daily levels from 5842 to 5837.75. If we break through 5837.75, expect further downside toward 5823.75, which has been repeatedly tested and may lead to further movement toward 5811 and 5802-5800 (a critical daily and 4-hour combo).

While I’m leaning slightly bearish due to the repeated failures at 5859.25 and 5870 over the past few sessions, anything can happen with the news tomorrow at 10:00 a.m. Keep a close eye on these levels, especially as 5841.50 will act as an important pivot zone—if it holds, it could spark another bounce, but a break will likely lead to deeper corrections.

Critical Levels to Watch:

5870 (Daily Resistance):

This level aligns with yesterday’s POC and will be a key marker for bulls. If price plays into this area but fails to hold above 5859.25, expect more downside pressure.5859.25 (Daily Leg End to ATHs):

This level has been our primary support toward the all-time highs. A sustained move below this level could quickly send price into the 5842-5837.75 zone.5842-5837.75 (Daily Cluster/4-Hour Support):

Previously tested multiple times, this area is now at risk of breaking. 5841.50 is an untested 4-hour level within this cluster, so any reaction here isn’t guaranteed. A break below this zone will likely trigger a move toward 5823.75.5823.75 (Daily Pivot):

A significant pivot level that will help us gauge momentum. Losing this level points to further downside with the next targets at 5811 and 5802-5800.

Lower Support Levels:

5802 - 5800 (Daily/4-Hour Combo):

This level provided a strong bounce last week, but further testing could weaken it. If it breaks, we’ll likely see continuation lower.5780.25 - 5778.25 (Weekly/Daily Line in the Sand):

Bulls need to defend this key area. If breached, expect further downside and watch for a potential shift in momentum.5755.75 - 5749.75 (Daily/Weekly Support Cluster):

This untested area is a prime buy zone with significant daily and weekly confluence. If this zone holds, expect a push back toward new all-time highs.5723 (Weekly Bull/Bear Line):

If the market slips below 5749.75, expect a fast move toward 5723—a critical boundary between bullish continuation and bearish momentum. Below this level, bears gain the upper hand.

Bearish Case:

5705.25 (4-Hour):

If 5723 fails, this will be the next downside target. Bulls must reclaim 5726 quickly to prevent acceleration to the downside.5690 (Weekly Leg Tip):

A break below this level confirms a shift toward bearish sentiment and opens the door to further selling pressure.5666.00 (Major Bull/Bear Line):

The final dividing line between bullish continuation and bearish momentum—losing this level signals that bears are fully in control.

Upside Levels to Monitor:

5908 (Daily Level):

Reclaiming this level on the daily close will restore bullish momentum and open the door to higher targets.5918.75 (4-Hour) and 5923 (Daily Resistance):

Both levels are untested and could trigger reactions if touched. Watch for potential pullbacks if price reaches these zones, but clearing them would push us toward resolving the unrepaired bullish imbalance.Unrepaired Bullish Imbalance:

While there’s no set timeline for when this will resolve, it remains a key part of our long-term bullish outlook.

Key Takeaways:

Critical Support Levels:

Monitor 5780, 5823.75, and 5859.25 for signs of momentum shifts.Buy Zone:

The 5755.75 - 5749.75 area is a high-probability support zone. If this level holds, expect another rally toward new all-time highs.Bullish Bias:

As long as 5859.25 holds, the bullish momentum remains intact. However, a break below 5823.75 will shift momentum to the downside.Upside Targets:

Watch 5918.75 (4-Hour) and 5923 (Daily) closely. Clearing these levels will keep the bulls in control and move us closer to resolving the imbalance above.

Stay sharp, follow the plan, and let’s conquer these markets!

Ryan Bailey

Vici Trading Solutions