Hello Traders,

Once again, the plan worked flawlessly! Our key support at 5853.50 held strong overnight and was tested again after the open, rejecting price and allowing the bulls to take control. Once we broke above 5869.50, a powerful squeeze followed, pushing us all the way to 5892. This move caught many bears off guard as price surged after clearing 5870 and continued higher for most of the afternoon.

The question now is: Was that all the sell-off we’re going to see, or will the bulls regain full control? Alternatively, will the bears step up and continue to push price lower?

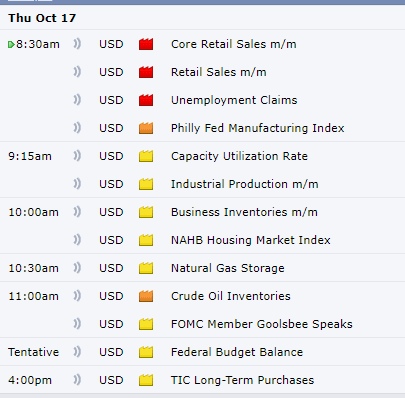

Tomorrow, we finally have some important red tag news—Core Retail Sales and Unemployment Claims—which should bring some volatility to the session. Given that we’ve seen low-volume trading so far this week, this news may cause some excitement. Take a look at the trade plan and levels below as we prepare for tomorrow.

News

Options VOL

Levels

Cheat Sheetz:

WK /DAY - TPO

WK /DAY

4hr

1HR

Trade Plan:

There is an untested 1hr / 4hr Cluster at 5869.50-5868 that we need to look for a potential reaction on first touch. This level may get played in the over night so we will use this as a guide for the AM if we are above or below this level

The 5853.50 level continues to be a key focus and will help us gauge momentum. If we hold above it, we could see a continuation higher. However, if we lose this level, we’ll look to the key support zones below to monitor for reactions. One important area to keep in mind:

1-Hour Cluster at 5840.75 - 5839.75

This 1-hour cluster also cleans up some single prints on the profile. I like this zone for a potential long entry. If we get a reaction here, it’s critical that we immediately reclaim 5853.50 to confirm upside continuation.

Key Levels to Watch:

5829.25 (4-Hour) / 5823.75 (Daily) / 5828 (POC):

This is a high-confluence zone with Friday’s POC and the previous weekly POC. The 5823.75 daily level will act as our above/below marker. A strong reaction is expected if this area is tested.

5802-5798.25 (4-Hour Cluster):

This zone includes an untested daily level at 5800 and offers an excellent spot for a long entry on first touch.

5813.25 (4-Hour Level) & 5808.50 (4-Hour Level):

The 5813.25 level has been tested multiple times and may not hold again. If 5808.50 plays, look for a quick reclaim of 5813.25 and a move to 5823.75 to confirm continuation.

5788.25 (4-Hour Level) & 5786.50 (1-Hour Level):

This zone has strong confluence with both the naked POC and the current week’s POC.

If 5788.25 plays, watch for a reclaim of 5794 (yesterday’s low) and a quick move back above 5800.

5780 (High Timeframe Line in the Sand):

As long as we remain above 5780, the bullish bias remains intact.

Untested Areas to Watch:

5908 (Untested Highs):

The highs from Tuesday’s fall, a potential target if we continue higher.

5829-5825 (4-Hour Cluster):

A significant zone for potential support.

5755.75 (Daily Level) & 5750 (Support Cluster):

This marks the new daily leg up. Stops for this zone should be placed below 5742.

Bearish Case:

If 5748.50 fails to hold, we could see a sharp move to the major weekly level at 5726.

5726 (Weekly Level):

This level has held several times but may not hold under heavy pressure.

5722 (Daily Level):

Immediate support after 5726. Losing this level could send us quickly into the 5709-5705 zone.

5709-5705 (4-Hour/Daily Combo):

Bulls need to reclaim 5726 quickly if this zone is tested, or the move lower may accelerate.

5690 (Weekly Leg Tip):

A sustained break below 5690 would signal a shift toward bearish momentum.

5668.75 (Major Bull/Bear Line):

This is the critical bull/bear line. Losing 5668.75 would fully shift momentum to the bears.

5661 (Daily/Weekly Combo):

If this level is tested, a quick reclaim of 5668.75 is necessary to prevent further breakdowns.

Key Takeaways:

Critical Support Levels:

Monitor 5780, 5823.75, and 5800 for momentum shifts.

Buy Zone:

The 5755.75-5748.50 zone should provide a solid reaction on the first touch. If it holds, expect a continued rally to new highs.

Bullish Bias:

As long as 5853.50 holds, the bullish momentum stays intact. However, losing 5823.75 could shift momentum lower.

Stay sharp, follow the plan, and together, let’s conquer these markets!

Ryan Bailey

Vici Trading Solutions