Good Morning, Traders!

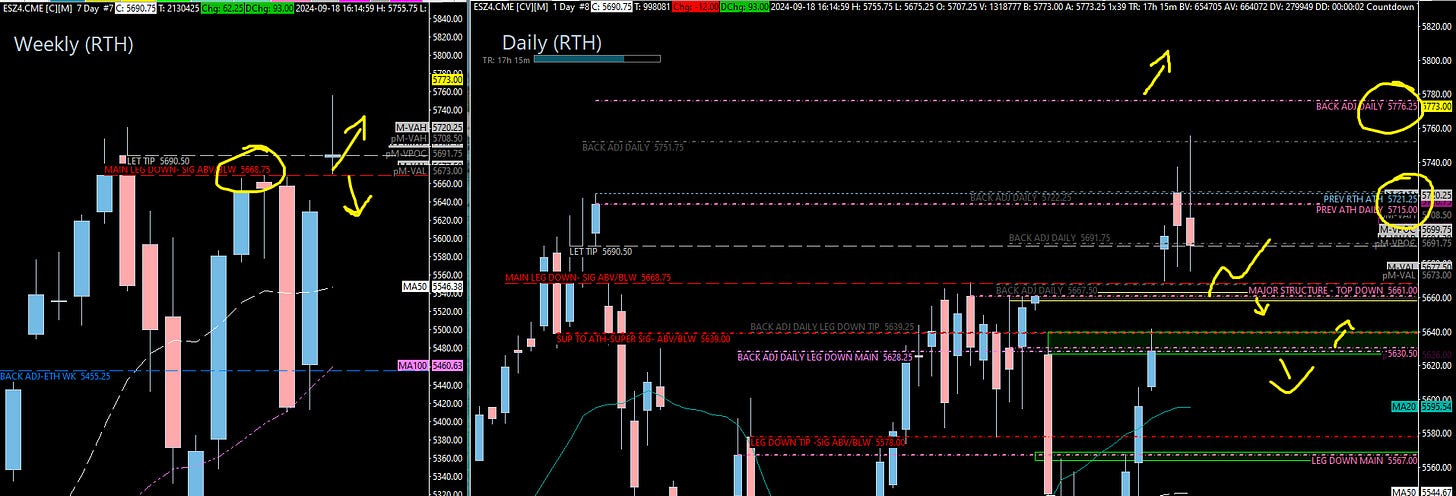

Once again, we find ourselves surfing all-time highs. Yesterday, the Fed lowered rates by 50 basis points with a commitment to cut another 50 basis points by the end of the year, totaling a 1% reduction. In addition, they've promised to drop rates by another full 1% in 2025, which is extremely bullish for equities. As a result, we’ve woken up to one of the largest gap-ups I’ve seen in a long time, with the market up nearly 100 points this morning.

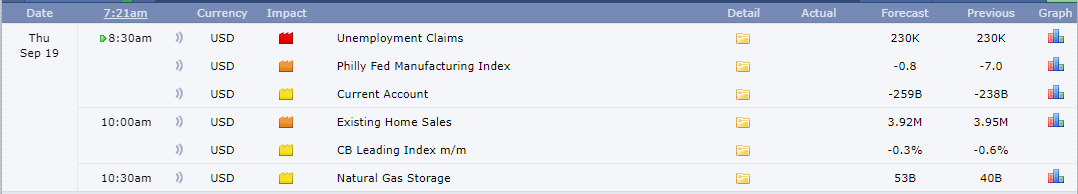

While this is a significant move, we also have unemployment claims being reported pre-market, which could add some volatility to an already tricky trading environment.

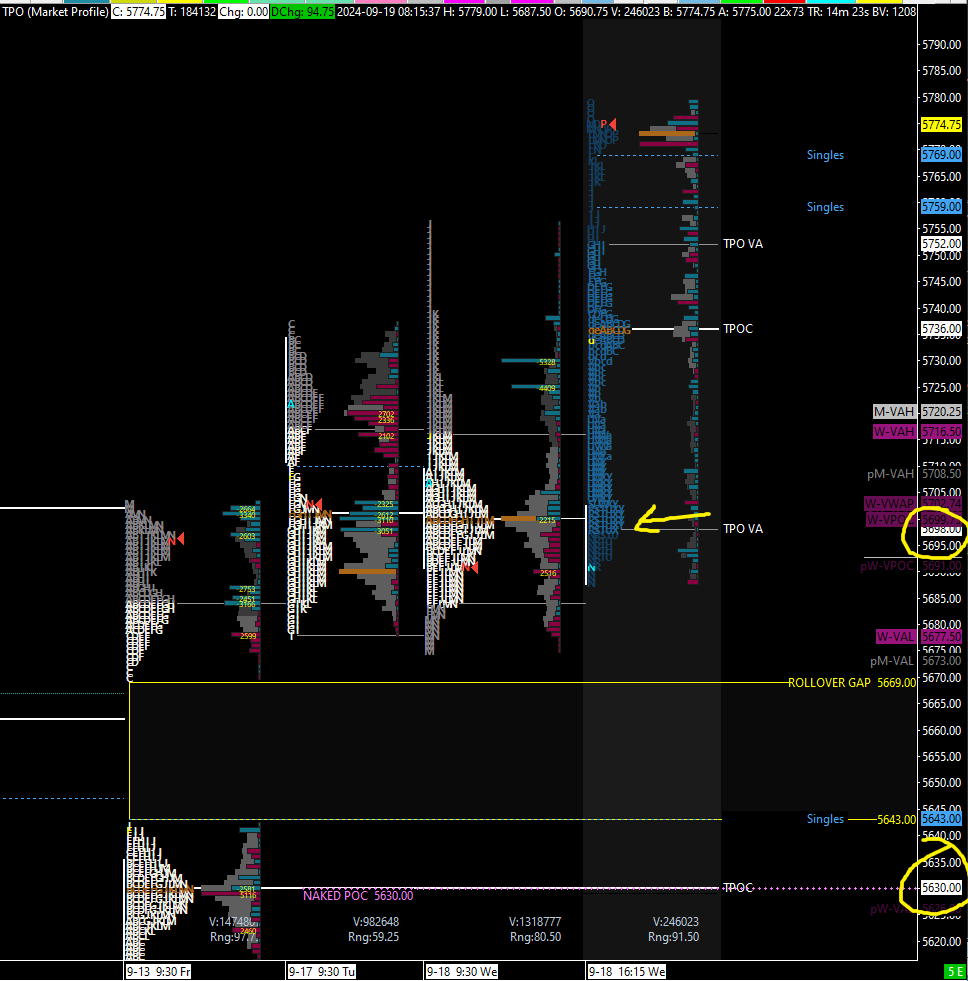

In light of these developments, I’ve restructured my approach to finding levels of support and resistance by combining rollover and back-adjusted charts to help guide us through the trading day as we navigate these all-time highs.

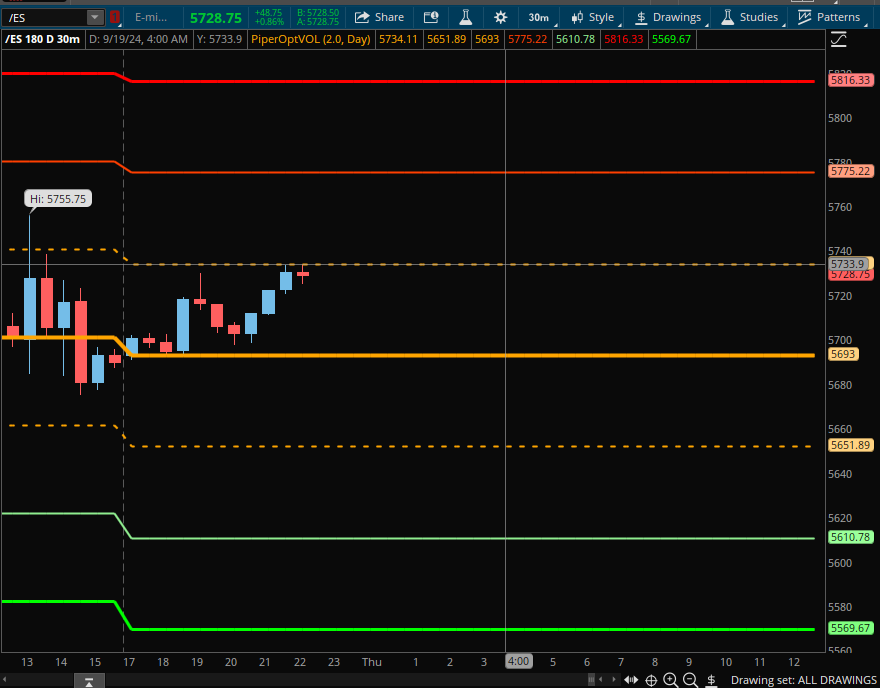

With the December contract now in play for ES futures, we’ve already hit the fourth deviation options vol level, which typically signals a possible overextension. We’re also bumping into the highest untested back-adjusted daily level at 5776.25.

As we roll into today’s session with this massive gap up, there’s plenty to go over. Below, you’ll find charts, the cheat sheet, and, most importantly, a detailed video where I break down the structure we’ll be trading today. Be smart, be patient, and let's conquer these markets.

Ryan Bailey

VICI Trading Solutions

NEWS

(Eastern Standard Time)

OPTIONS VOL

TRADE PLAN:

For Shorts:

Short setups today will be scalp opportunities. Given the significant overnight push, I am not particularly interested in aggressive shorts unless we see a strong reaction at key levels.

5776.25 (Untested Daily Level- Back Adjusted):

This is the last major area of resistance I have before we move higher. This level could provide a reaction this morning, potentially pulling back as inventory may be off-balance pre-market. However, due to the strong bullish sentiment, any shorts here would be for quick scalps.

For Longs:

We have established several key support areas that provide excellent opportunities for potential long setups:

5757 (4-Hour/Yesterday's High):

This is derived from a back-adjusted chart and corresponds to yesterday’s high. This level may offer a strong opportunity for a long entry. However, given the massive 100-point push overnight, I am cautious about buying the first level of support after such a big move. I would be looking for confirmation and will likely trade half size here, depending on the reaction.5718-5715.50 (1-Hour/Daily Levels):

This is a combination of two 1-hour levels and an untested daily level from our previous all-time highs. This level is untested from the top down, which could provide a strong reaction. My plan is to initiate with small size here, and once the price reclaims 5722.25, I would add full size and trail runners as the price continues to rise.5706.25-5705.25 (4-Hour/1-Hour Combo):

This level, supported by yesterday's POC and the Globex leg start, is a fantastic area for potential long entries. If price reaches this level, I would look for an immediate reclaim of 5715 (1-Hour structure) and 5722, before adding size to the position. Targets would be taken as price moves above these support structures.

If the market makes a deeper move down and breaches yesterday’s low, the next key area to watch is 5661, which is an untested daily level. However, the weekly level at 5668 remains the most crucial area on the chart, signifying control between bulls and bears. This level has been significant for weeks and will continue to be a key reference point.

If We Test Lower into 5639 or 5630.50-5626 (Daily/4-Hour Combo):

Should the market continue to drop, the 5639 daily level will act as a guide. This level has been tested but remains extremely important. Below this, the 5630.50-5626 daily/4-hour combination provides strong context and confluence from the previous move up. If this level holds, we would want to see the price quickly reclaim 5639, with initial targets at 5658 and 5661, ultimately looking for a return above 5668.75 to confirm we are on the right side of the move.In Summary:

The market is in uncharted territory with significant bullish momentum, but we must remain cautious due to the size of the overnight gap and the potential for volatility from unemployment claims data. As always, patience and discipline are key. Watch the video for a more detailed breakdown of today’s setups, and let’s execute with precision. Let’s conquer these markets together!

CHEAT SHEET

Dailys:

Back Adj

REG RTH CHART

4HR

1HR

MORNING OUTLOOK