Good Morning Traders!

Today is shaping up to be one of the most pivotal days of the year as we await the FOMC announcement, where rate cuts are the central focus. The debate isn’t if rates will be cut, but by how much. The market is torn between a 25, 50, or even 75 basis point cut. All of these potential cuts are bullish for the market, as lower rates make borrowing cheaper for companies, improving their bottom lines.

It's a bit unusual to be discussing rate cuts while the market is near all-time highs. However, with rates at 5.5% and inflation approaching the Fed’s 2% target, the timing makes sense. The deeper the rate cut, the more bullish we can expect the market to be. The consensus is pricing in a 50 basis point cut, which was reflected in last week’s bullish action, but that doesn’t mean we can’t move higher. As volatile as FOMC day can be, the trend is still up, and that remains the default direction unless something drastic is announced.

This doesn’t mean there won’t be short opportunities, but the general direction is up. Unless the Fed offers a negative surprise, we could very well see a push to all-time highs on the September contract. Keep in mind that many stocks, especially in the Russell 2000 and heavily tech-weighted S&P companies, are sensitive to rate cuts and could benefit significantly if rates are reduced further.

Key Outlook:

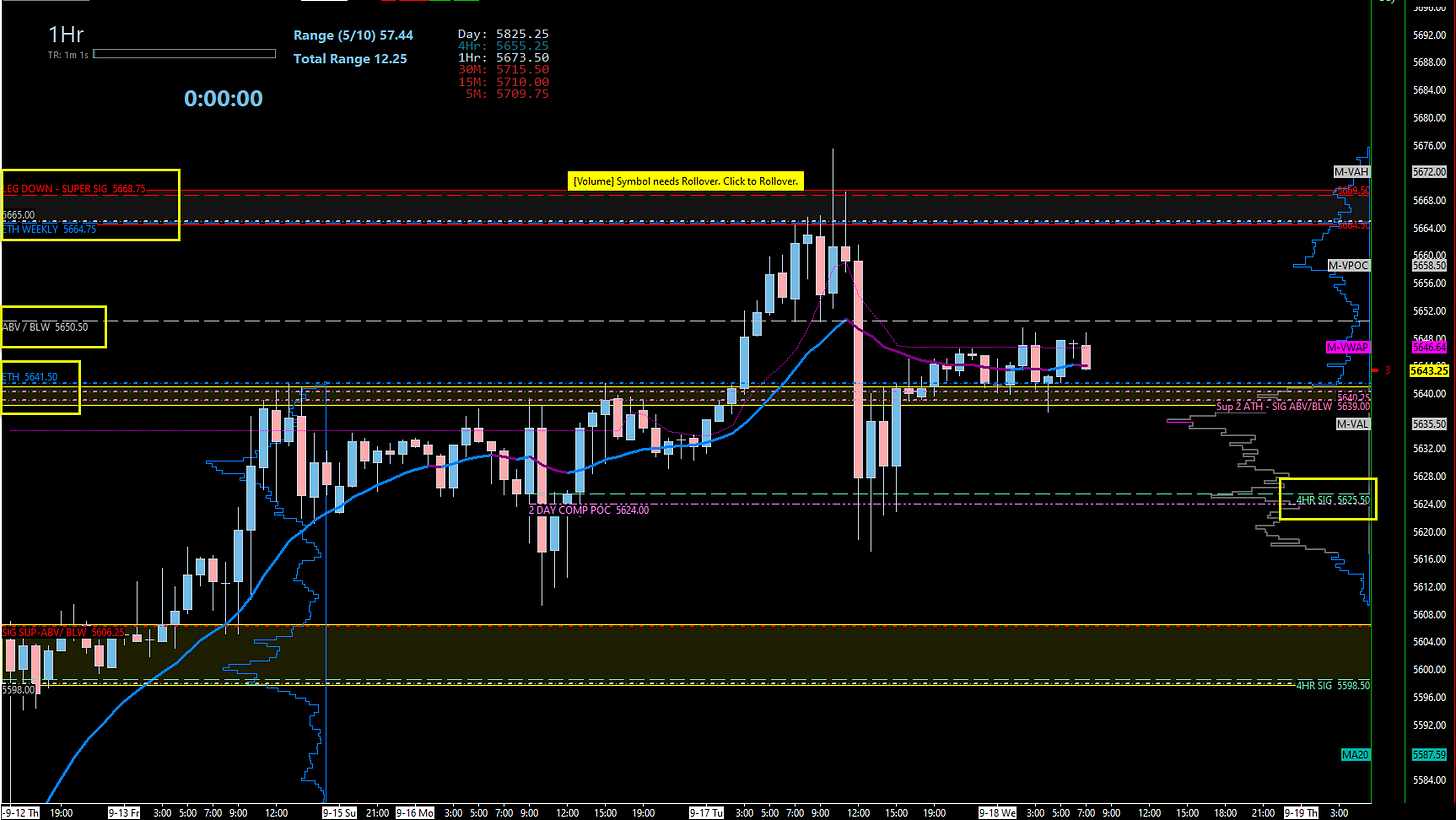

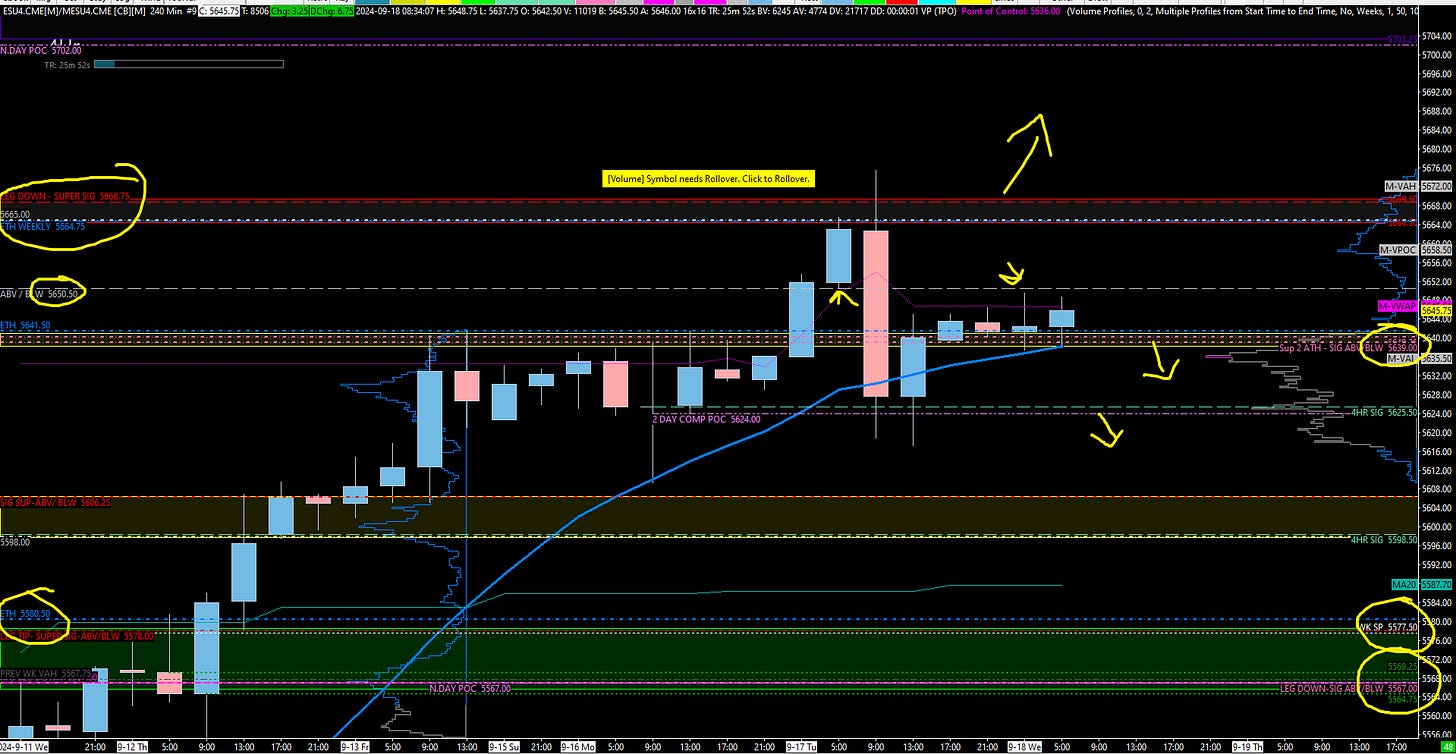

As we head into the FOMC, it's important to focus on the Weekly Volume Profile pre-announcement. On the 4-hour chart shown, there is a large bullish imbalance between 5642 and 5660. This imbalance suggests that the market is "thin" in this area, and price will likely revert back to these levels to "repair" the structure at some point. This zone is critical because markets tend to revisit areas of imbalance to stabilize before deciding on further movement.

On the flip side, the 5668.75 zone that we've been discussing for weeks has continued to provide strong resistance. Over the last four weeks, this level has seen four separate touches and rejections, signaling it as a key barrier. Today will be especially interesting as we see whether this level holds or if the FOMC provides the fuel for a breakout.

My Personal Approach to FOMC Days:

In my 10 years of trading the ES, I can confidently say that FOMC days are not my most profitable. Personally, I avoid trading after the announcement due to the extreme volatility that typically ensues. Instead, I prefer trading pre-announcement when the market is calmer, and then I wait until the following day when the dust settles.

The reason for this is simple: after the FOMC announcement, algos take over, volatility skyrockets, and it turns into a trap fest. Key levels that normally hold strong can get blown through with little reaction. My advice? If you must trade today, focus on pre-announcement scalps. If you plan to trade during the announcement, size way down and expect increased volatility.

Check below for my trade plan today and remember to be safe be patient and the markets will always be here tomorrow so no need to force a trade. Keep these small things in mind and together we will conquer the markets!

Happy Trading,

Ryan Bailey

VICI Trading Solutions

NEWS

OPTIONS VOL

As you’ve noticed, September options levels are no longer available. I’ve included December options levels for today.

Rollover Reminder:

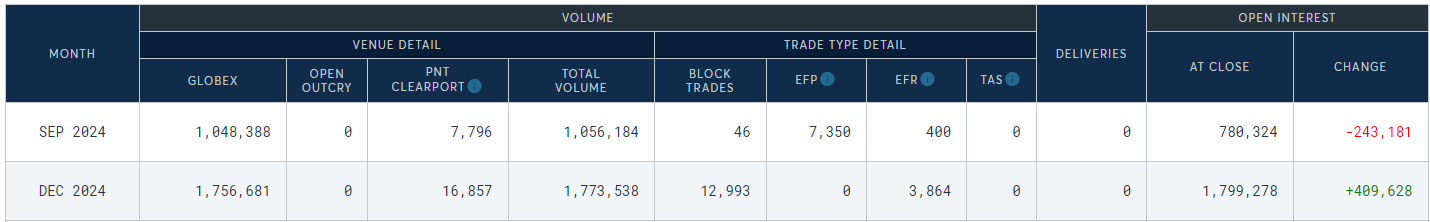

We’re still in the middle of rollover for the ES futures contract, but I won’t be rolling over until after the FOMC today. The volume has now officially shifted to the December contract, so today will be my last day trading September. Tomorrow, I will transition to December. You can see the shift in volume on the CME graph.

For Think-or-Swim users, you can access the September contract by typing “/ESU24”.

For TradingView users, simply type in the symbol and select the September contract.

TRADE PLAN

Key Levels of "Static Support" (Tested Support Levels That Still Hold Strong Confluence):

5664.75-5668.75 (Daily/Weekly Zone): This zone has provided significant resistance for four weeks, offering multiple rejections. Monitor this area closely, especially pre-announcement. It has been a strong barrier, and a breakout here could lead to an aggressive move upward.

5650.50 (Weekly Level): Another important level to watch, providing strong support/resistance. This can act as a key guide for further market progression.

5639-5641.50 (Daily Cluster): A strong cluster of daily levels, this acts as a line in the sand. Whether we stay above or below this zone will determine the market's direction for the day.

5625.50 (4-Hour & 2-Day Composite POC): This level represents the Point of Control (POC) from the composite (combined) of two days' worth of price action. It can be a key level of support for longer-term positioning.

Shorts:

Keep in mind that resistance is thinning as we approach all-time highs (ATHs) on the September contract. If you’re trading the December contract, you may already be at ATHs.

5664.75-5668.75 (Resistance Zone):

- This area has provided resistance, but if the price pushes through, it could turn into support. A short here would be a scalp only, as the trend is still up, and a breakout could happen swiftly.

5715 (Untested Daily Level):

- This is an untested daily level, and it’s the final resistance before all-time highs on the September contract. While not the most attractive setup, if you decide to short here, keep stops tight, likely just above ATHs.

Trade Plan If We Move Lower:

Longs:

Given the current location, long setups will only become highly probable if we move lower into key support levels:

5564.75-5569.25 (4-Hour/Daily Combination):

- This area has strong confluence, including Thursday’s POC, last week's value area high, and multiple monthly/daily/4-hour levels. I would look to buy in this zone, targeting 5578. If the price reclaims 5580.50, I would add full size and trail higher.

Lower Buy at 5532 (Significant Daily/Weekly Level):

- If we drop to 5532, exercise caution and enter with half size. Look for a reclaim of Thursday’s low and a move above 5543.75 (4-Hour) before adding to the position. Targets would be 5564.75 and beyond.

Final Long Opportunity at 5513.75-5516.25:

- This level offers significant daily support and should provide a reaction. However, it needs to reclaim 5532 quickly to keep long interest. Below 5500, bulls will face significant challenges, and long setups will become much riskier.

In Conclusion:

FOMC days are unpredictable and tend to bring extreme volatility. If you must trade, focus on pre-announcement scalps and size down significantly during the announcement. Be prepared for rapid movements as algos take over, and key levels may not hold as they usually do. Stay safe, stick to your plan, and be ready to act once the dust settles.

Let’s conquer these markets together!

CHEAT SHEETS

DAILY / WEEKLY TPO

RTH DAILY

4HR

1HR

MORNING OUTLOOK