Good Morning, Traders—Happy Monday!

This week is guaranteed to be full of excitement with several key economic events on the horizon:

Tuesday: Core Retail Sales

Wednesday: FOMC Meeting

Thursday: Unemployment Claims

In the midst of all this, we have the rollover for the ES Futures Contract. The Think-or-Swim platform has already rolled over, but TradingView has not. Personally, I will not be rolling over until after the FOMC on Wednesday. I've been tracking the volume, and we're not ready to roll over on a volume basis. Moreover, the price action and support and resistance levels are extremely clear on the September contract. Given the clean and well-defined structure, I want to push this contract as far as I can.

Note for Think-or-Swim Users: If you want to revert back to the September contract, you can type in /ESU24 to access that specific month.

I've also included the options levels; however, as you've noticed, the options levels for the September contract are non-existent since the Think-or-Swim platform has already rolled over to December. Therefore, I have included the December options levels for today.

Today's Outlook:

We have no significant news to speak of today. The Empire State Manufacturing Index is released this morning pre-market, but it's not a red tag event, and I do not expect it to create much volatility.

We had an extensive 3-day push last week, and more than likely, the market will want to digest this move, which could lead to a balance day. Generally, after a very large rally, price will stabilize and balance as buyers and sellers continue to accept value in the new price range.

It's crucial to stay patient today, as volatility could be muted due to the significant news events coming over the next three days. For those of you who watched the weekend review, our trade plan is still intact and has not changed—you'll find that located below.

Remember to stay calm, stay patient, and don't force trades. Together, we will conquer the markets.

Have a great trading day!

Ryan Bailey

VICI Trading Solutions

NEWS:

NO SIGNIFICANT NEWS EVENTS TODAY!

OPTIONS VOL:

PRE ROLL SEPT CONT

NO LEVELS

POST ROLL- DEC CONTRACT

TRADE PLAN:

Shorts:

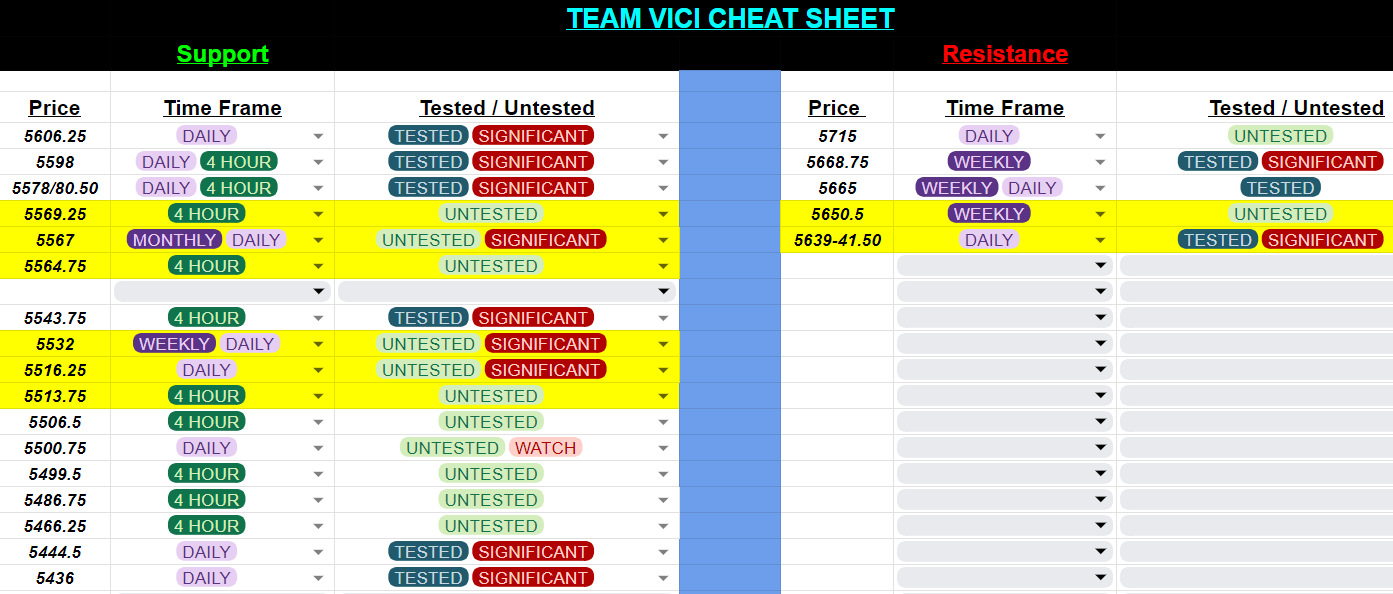

- Overhead Resistance: We face significant resistance between 5639 and 5650. This area could challenge the current price action, potentially leading to a pullback as it did in the previous weeks.

5639-5641 is our key daily area, with a weekly level at 5650.50—also a gap fill. If the price pops up to 5650 and then drops below 5639, this could set up a short. Targets should be taken line-to-line due to the bulls’ strong control.

First Target: 5606, followed by 5598.50.

- Further Drop: If 5598.50 is lost, a continued short could push the price to 5578 and potentially 5564.75. Caution is advised below 5578 as these levels have previously provided significant reactions.

Longs:

5564.75-5569.25 (4-Hour/Daily Combination):

- This zone shows strong confluence, including the Thursdays POC and last weeks value area high along with Monthly, Daily & 4HR levels. I’d consider buying here with initial targets around 5578. If the price reclaims 5580.50, I’d re-add full size and trail the trade higher.

Lower Buy at 5532 (Significant Daily/Weekly Level):

- If the price drops to 5532, be cautious and bid with half size. Look for a reclaim of Thursday’s low and a move above 5543.75 (4-Hour) before increasing position size. Targets would be 5564.75 and higher.

Final Long Opportunity at 5513.75-5516.25:

- This area is significant daily support and may offer a reaction. However, this level needs to immediately reclaim 5532 to maintain long interest. As we move lower, support becomes weaker, posing additional challenges for bulls. Below 5500, bulls may struggle to retain control and long opportunities become a lower probability of success.

Final Note

Regardless of whether the market continues to push up immediately or pulls back before rallying again, the range between 5639 and 5668.78 will be challenging. A breakout above 5668.75 could signal a strong move higher targeting our upside daily at 5715.

CHEATSHEETZ:

Highlighted levels are levels of Focus

Weekly TPO

Daily TPO

RTH DAILY

4HR

1HR

MORNING OUTLOOK: