Happy Monday, Traders,

We’ve seen quite a push-up in the Globex session, but the bulls aren't out of the woods yet. This move still looks like it could be a temporary pop, setting up for another potential short. So, be very cautious with long trades today until we gain a 4-hour support at 5514—holding longs could be risky.

Key Levels to Watch:

Downside: Our Weekly Pivot is 5444.50 so we want to monitor being above or below this however our major line in the sand today is 5436.50. Falling below this level will indicate weakness among daily buyers, with minor support potentially emerging around 5419-5420. This is what Globex managed to gain last night. If we drop below 5419, we could see a slip down to the 5452 area, with our first target around 5371.

Upside: On the upside, focus on the 5489.75 to 5494 area for untested 4-hour and 1-hour resistance. Beyond that, our next significant resistance is at 5513.75, which I see as a high-probability short level. This aligns with the 5516.25 daily level, which was crucial on Friday.

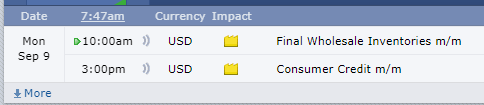

We don't have any major news events or red tag events today, so volatility could be low. Be patient, wait for high-probability setups.

I hope you all have an excellent day and let’s conquer these markets together.!

Ryan Bailey

VICI Trading Solutions

NEWS

Options VOL

Cheat Sheets:

Morning Outlook

Thank you

hi new here, what would you say is the best way to get intraday data on the options vol? thank you