Hello Traders!!

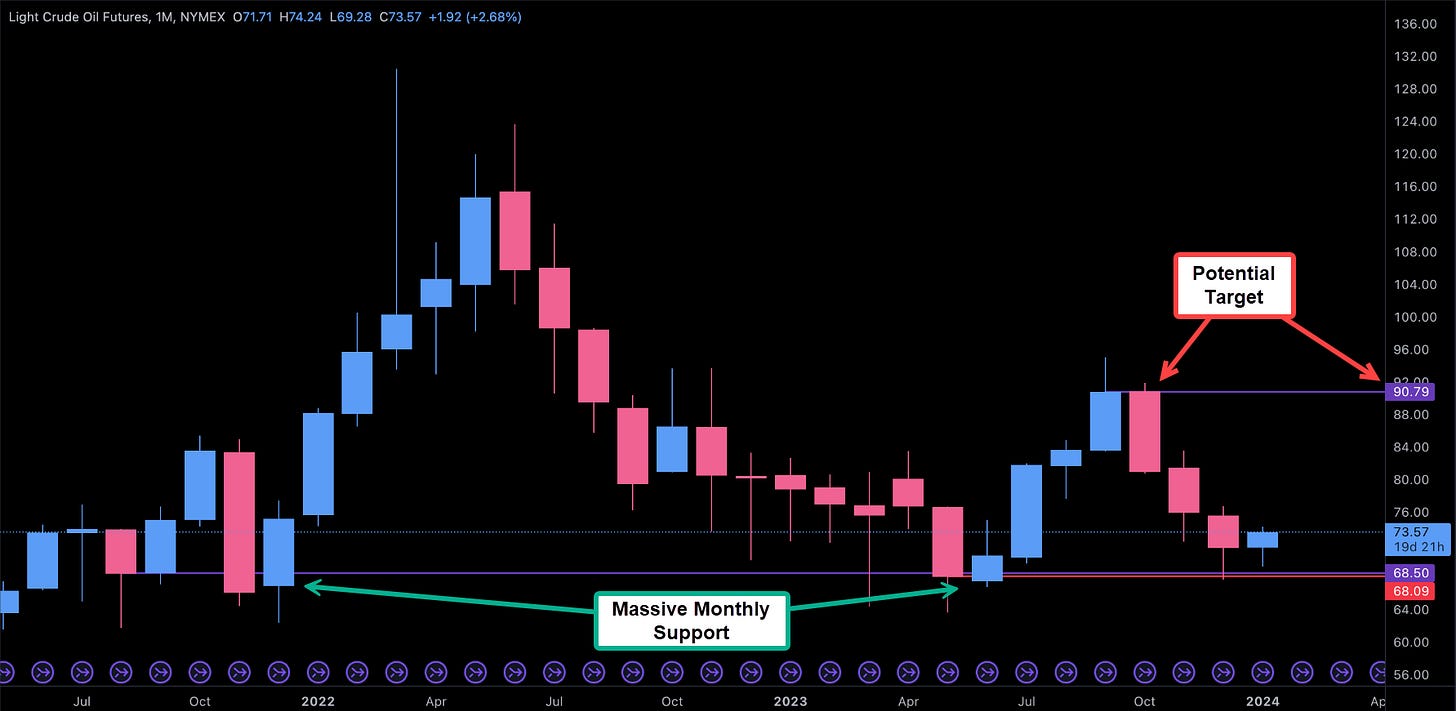

Let's dive into the current dynamics of crude oil. Specifically WTI Crude Oil Futures. Recently, crude has been hovering in a significant balance area, retreating from its previous highs of around $120. But, there's a catch: it's been clinging to a substantial monthly leg, suggesting a strong support base. For about six weeks, we've seen crude making consistent higher lows within this range, hinting at a potential accumulation phase.

Monthly Time Frame:

In our Discord discussions, I've been highlighting how crude seems primed for a rally, especially if it maintains these lows. And now, it seems like that rally might just be on the horizon. We've observed a lot of action within a key weekly zone, and despite thorough testing, prices are inching upwards. Keep an eye on the $73.80 resistance mark. Breaking past this could signal a steep rise, and yes, that might mean shelling out more at the gas station. Imagine the pent-up energy from weeks of accumulation suddenly being unleashed – we could see some serious momentum.

Weekly Time Frame:

The big question is: Will crude oil break through this ceiling? Signs are pointing towards a strong possibility. If we take a step back and look at the higher time frame, everything below $80 has been tested, indicating room for even higher climbs if we break out of this range. It's not certain, but it sure is going to be exciting to watch, analyze, and maybe even profit from, provided our technical analysis holds true.

Daily Time Frame:

4 Hour Time Frame:

So, let's stay tuned and see how this unfolds. Could be a thrilling ride ahead for crude oil!

Cheers,

Ryan Bailey AKA - Master Bailey :)